Explore the latest trends, market data, and export insights for the UAE’s shipments to global markets.

This guide highlights trade opportunities, key export categories, trading partners, and essential HS code information to help businesses make informed export decisions.

🔹 Introduction

The United Arab Emirates has transformed from an oil-based economy into a dynamic global trading hub. In 2024, total exports crossed USD 490 billion, reflecting solid performance across both traditional sectors like crude oil and emerging industries such as gold, aluminum, and electrical equipment.

The UAE’s strategic location, world-class ports, and free-trade zones make it one of the most connected export economies worldwide. This guide breaks down the UAE’s top 10 export categories, key markets, HS codes, and how exporters can leverage Exim Data Hub to scale confidently in 2025.

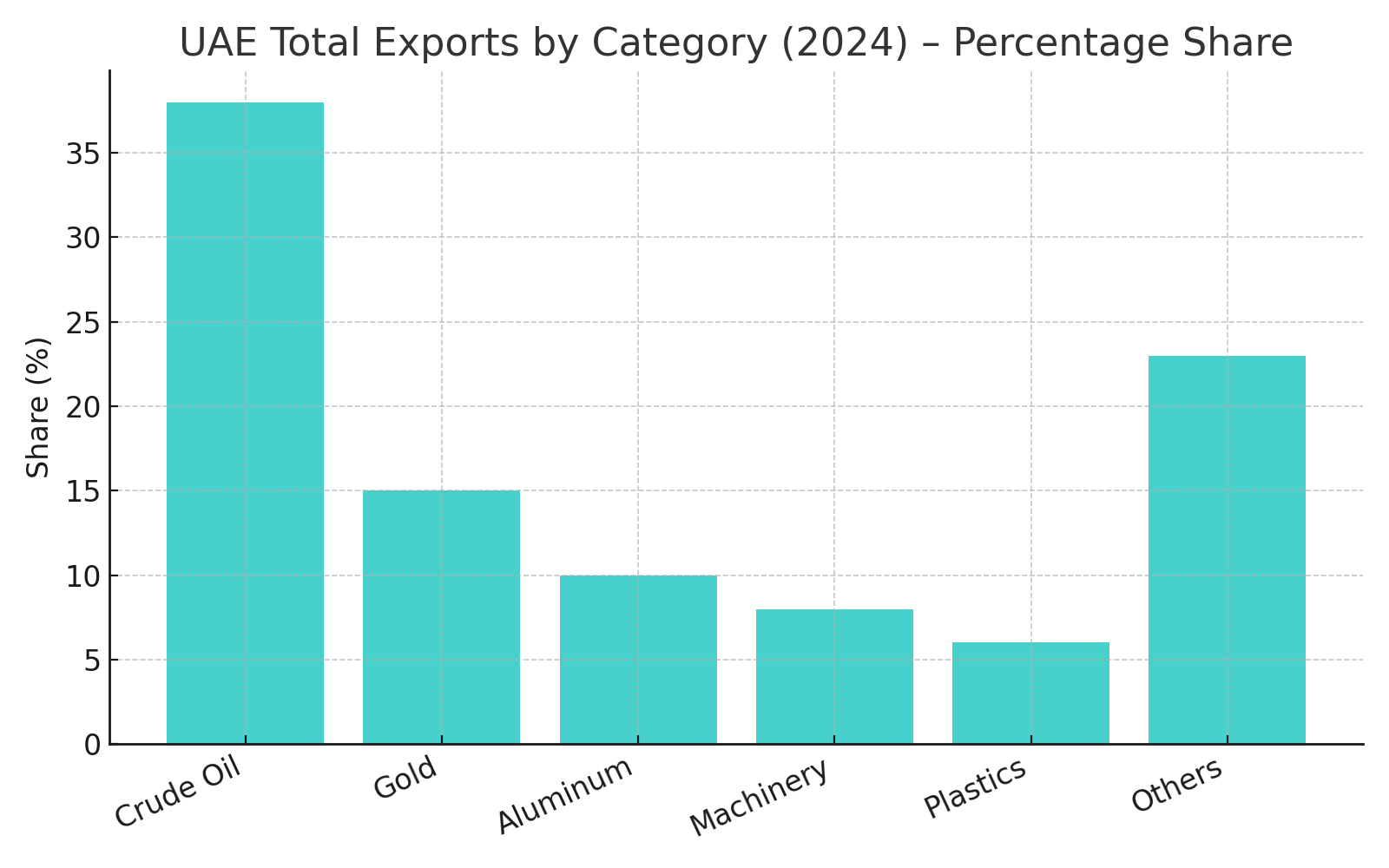

🔹 What Are the UAE’s Top Exports?

➤ Crude Oil & Petroleum Products – The foundation of the UAE’s export economy, shipped mainly to Asia and Europe.

➤ Gold & Precious Metals – Refined gold bars and jewelry make the UAE one of the world’s largest bullion hubs.

➤ Natural Gas & LNG – Exported to Japan, South Korea, and India.

➤ Aluminum & Base Metals – Industrial-grade aluminum, steel, and copper for construction and automotive manufacturing.

➤ Machinery & Electrical Equipment – Cables, transformers, and electronics for Middle Eastern and African buyers.

➤ Plastics & Polymers – Raw and processed materials for global manufacturing.

➤ Chemicals & Fertilizers – Petrochemical derivatives and agricultural inputs.

➤ Vehicles & Transport Equipment – Cars, trucks, and aircraft parts re-exported through Jebel Ali.

➤ Food & Beverage Products – Dates, dairy, and processed food items increasingly reaching Asian and African markets.

➤ Textiles & Garments – A smaller but growing export segment supplying regional retailers.

These categories show how the UAE balances energy strength with diversified manufacturing and re-export capabilities.

🔹 Key Market Trends in UAE Trade

| Market Driver | Description |

|---|---|

| ➤ Energy Diversification | Expanding exports in aluminum, polymers, and gold beyond hydrocarbons. |

| ➤ Green Trade Transition | Focus on renewable energy equipment and sustainable manufacturing. |

| ➤ Free Trade Zone Expansion | New logistics corridors like Jebel Ali & Khalifa Port driving global re-exports. |

In 2024, oil exports remained dominant at USD 190 billion, while non-oil exports surged past USD 150 billion, led by gold, aluminum, and machinery.

The second half of 2024 showed strong demand from India, China, and Saudi Arabia, particularly for refined metals and re-exported electronics.

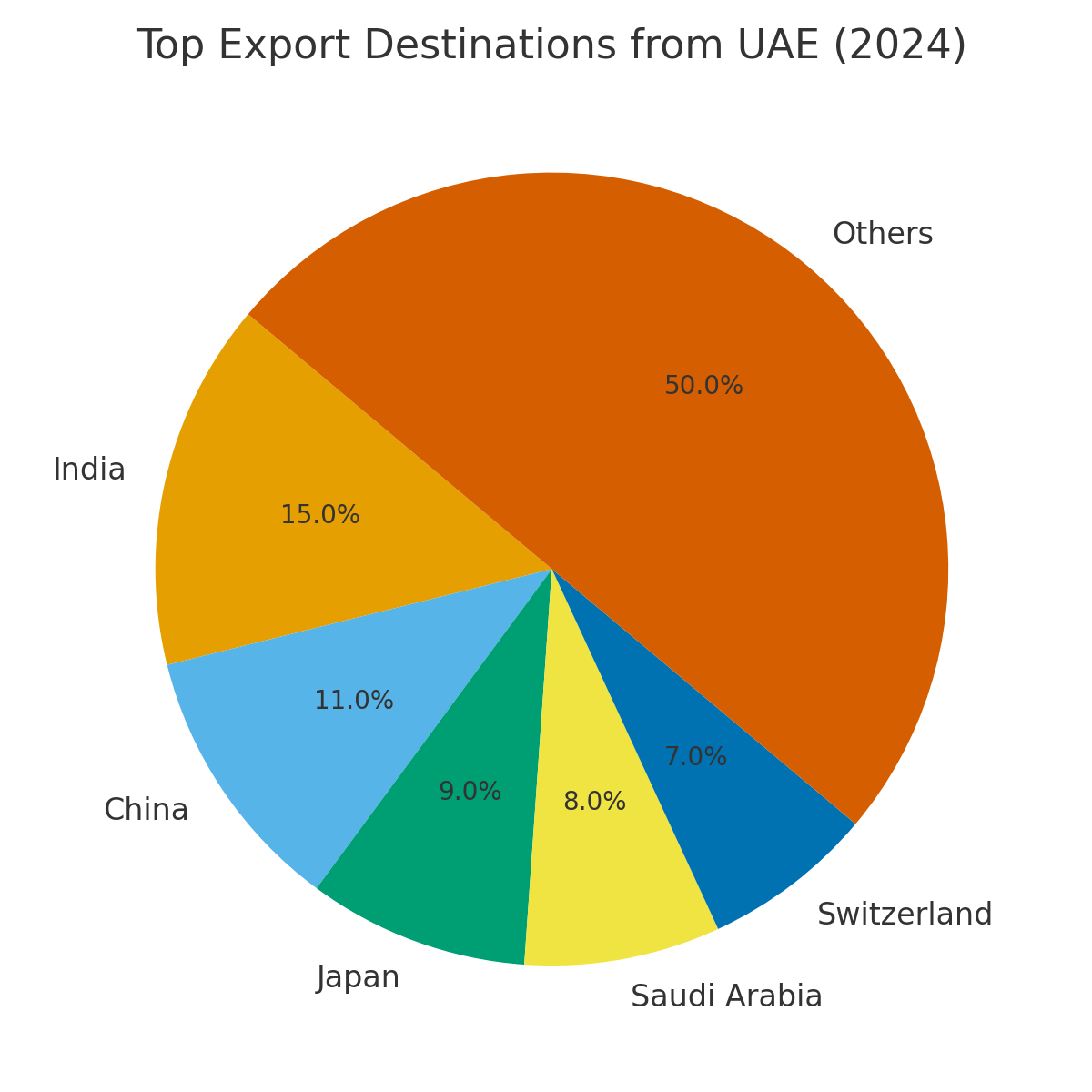

🔹 Top Export Destinations of the UAE

| Destination | Share of Exports (%) |

|---|---|

| ➤ India | 15 % |

| ➤ China | 11 % |

| ➤ Japan | 9 % |

| ➤ Saudi Arabia | 8 % |

| ➤ Switzerland | 7 % |

➤ India remains the UAE’s largest trading partner, mainly importing oil, gold, and jewelry

➤ China and Japan drive industrial-product and energy imports.

➤ Switzerland and Saudi Arabia lead in gold trade and aluminum

🔹 Opportunities for Exporters

➤ Leverage the UAE’s free-trade zones for lower duties and faster logistics.

➤ Offer eco-certified metals and low-carbon aluminum to meet global sustainability standards.

➤ Build niche segments in gold refining, polymers, and automotive parts.

➤ Target African and South Asian markets where re-export demand is rising.

➤ Use Exim Data Hub to identify verified importers and optimize HS classification.

🔹 HS Codes for the UAE’s Major Export Lines

➤ 27090000 – Crude oil and petroleum oils

➤ 71081200 – Gold

➤ 76011000 – Aluminum unwrought

➤ 27111100 – Liquefied natural gas

➤ 39021000 – Polypropylene in primary forms

Having the correct HS code ensures faster customs clearance and precise tariff assessment.

For live HS data and buyer insights, visit Exim Data Hub or explore official trade resources like the World Integrated Trade Solution (WITS).

🔹 How Exim Data Hub Helps Exporters

| Feature | Exporter Benefit |

|---|---|

| ➤ HS Code Intelligence | Classify goods accurately and avoid clearance delays. |

| ➤ Buyer/Seller Insights | Get verified importer lists by product and region. |

| ➤ Forecast Reports | Plan export volumes based on seasonal demand trends. |

| ➤ Compliance Tools | Stay updated on shipping documents and tariff rules. |

Whether you’re a first-time exporter or managing a logistics network, Exim Data Hub gives you everything you need to track demand, discover buyers, and stay compliant across 100+ markets.

You can also Check macro-trade trends through the International Trade Centre’s Trade Map for further benchmarking.

🔹 Conclusion

➤ The UAE’s export strength lies in both energy and value-added industries.

➤ With diversified trading partners and modern logistics, it continues to shape Middle East trade.

➤ Using the right HS codes and real-time data tools ensures smoother documentation and competitive pricing.

🔹 Frequently Asked Questions (FAQ)

Q1: Is certification required for exporting oil, gold, or aluminum from the UAE?

Yes — exporters must follow ISO and sustainability compliance for international buyers.

Q2: How big is the UAE’s non-oil export market?

Non-oil exports crossed USD 150 billion in 2024 and are projected to rise further in 2025.

Q3: What are the fastest-growing segments for 2025?

Renewable energy equipment, low-carbon aluminum, and polymer-based materials lead the growth.