Explore the latest trends, market data, and export insights for organic product shipments to Europe. This guide highlights global trade opportunities, top exporting countries, and essential HS code information to help Indian exporters make smart, data-driven moves.

🔹 Introduction

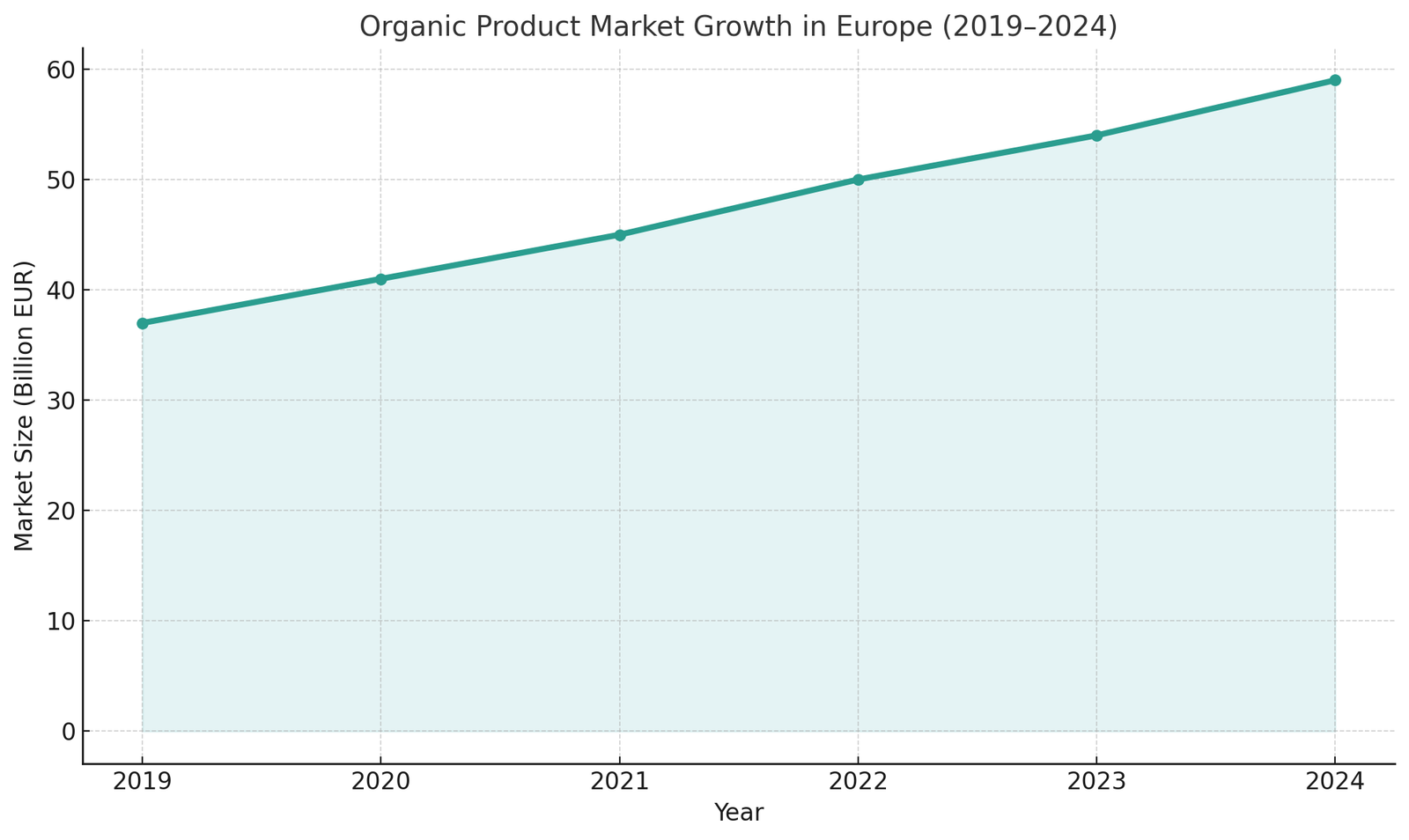

The European market for organic products has grown steadily over the last five years, driven by consumer interest in clean, sustainable living. In 2024, the total market size in Europe touched €59 billion, with increasing imports from countries like India.

Exporters across India are now looking to meet this demand by supplying certified organic food, spices, teas, and wellness products. This guide helps you understand what’s in demand, which countries to target, and how to plan better using tools like EximDataHub.

🔹 What Are Organic Exports?

Organic exports refer to products grown without synthetic chemicals, pesticides, or genetically modified inputs. These goods are usually certified by a recognized organic body—something that’s required for export to Europe.

Some of the most popular organic items exported from India to Europe include:

➤ Herbal and green teas like Tulsi and Chamomile

➤ Dried spices including turmeric, cumin, and black pepper

➤ Organic rice, especially basmati

➤ Forest honey and cold-pressed oils

➤ Fresh or dried organic fruits and herbs

These items align well with European values around clean food, sustainability, and transparent supply chains. Indian exporters who offer traceability and quality packaging stand to gain the most.

🔹 Key Market Trends in Europe

| Market Driver | Description |

|---|---|

| Rise in Health Awareness | Post-pandemic lifestyle changes are pushing consumers toward chemical-free food |

| Demand for Sustainable Sourcing | European buyers prefer traceable, ethically sourced ingredients |

| E-commerce Acceleration | Online grocery and organic platforms are rapidly expanding across the EU |

From 2019 to 2024, Europe’s organic food market rose from €37 billion to €59 billion, and the upward trend continues.

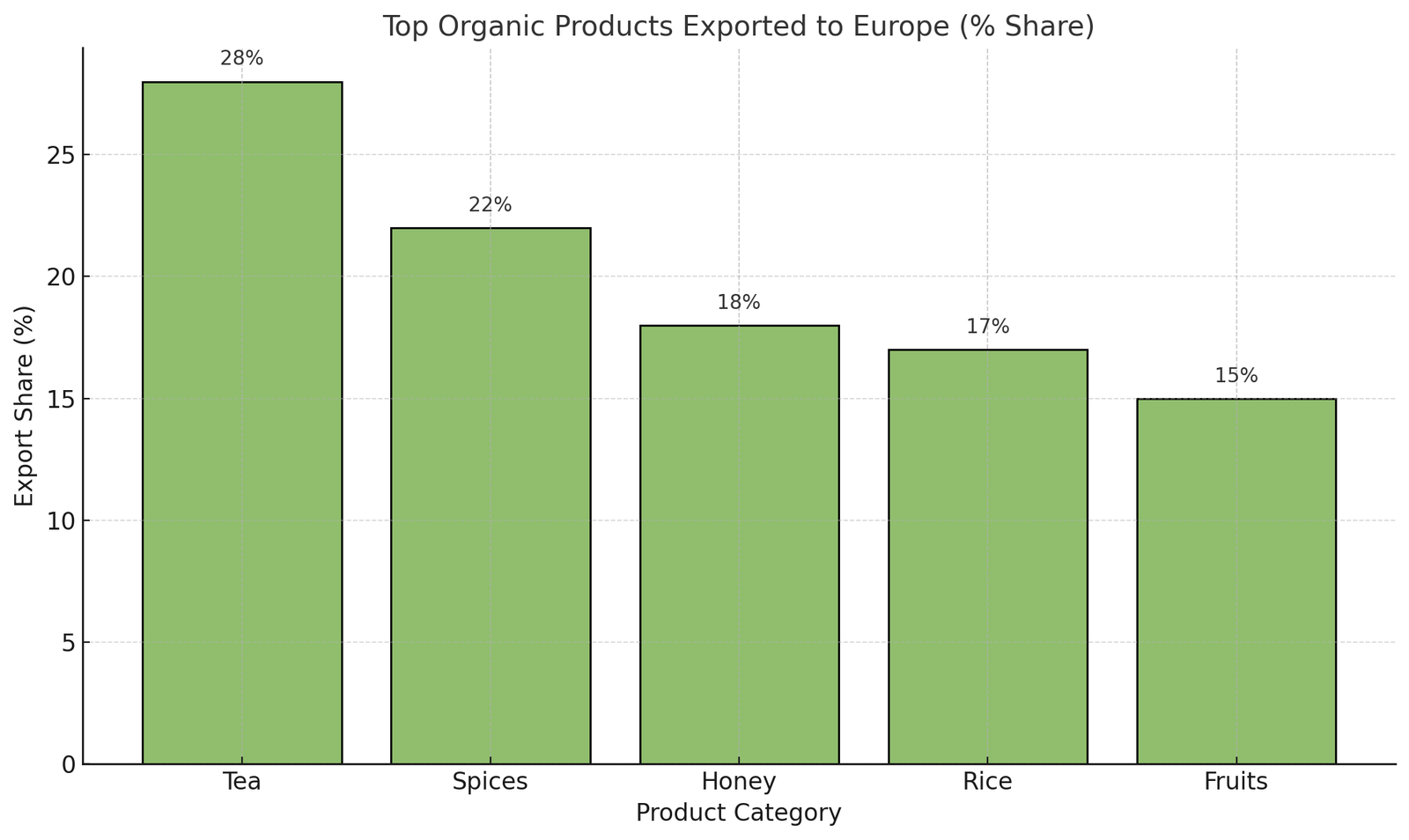

The most in-demand organic categories include teas, spices, and honey. These products are not only popular for daily consumption but also form part of the growing wellness and clean-label movement in Europe.

To stay ahead, exporters should keep an eye on import data and adjust their volume and pricing strategies. This EU overview of organic rules gives clear insight into labeling and certification requirements.

🔹 Top Exporting Countries

| Country | Export Share (%) |

|---|---|

| India | 32% |

| Netherlands | 20% |

| China | 15% |

| Sri Lanka | 10% |

| Turkey | 8% |

India continues to lead due to its diverse farming zones, cost-effective labor, and growing organic certification infrastructure. Countries like the Netherlands serve as key hubs, distributing to the rest of the EU after importing in bulk.

🔹 Opportunities

Exporters looking to grow in Europe should consider:

➤ Higher margins through fair-trade and organic certifications

➤ Demand for clean-label packaging and QR code traceability

➤ Untapped categories like organic moringa, millets, and dry herbs

➤ Increased buyer interest in Ayurvedic and functional ingredients

With detailed market intelligence from EximDataHub, you can identify high-growth zones and avoid oversaturated product lines.

🔹 HS Codes for Organic Products

Correct HS classification helps speed up customs clearance and ensures lower rejection rates. Common HS codes include:

➤ 09024010 – Organic black/green tea

➤ 09109990 – Organic spice mixes or unlisted spices

➤ 04090000 – Organic forest or raw honey

➤ 08045020 – Organic mangoes and tropical fruit (fresh/dried)

If your product is processed or value-added, it may fall under different codes. Use verified tools or consult with EximDataHub to avoid delays.

🔹 How Exim Data Hub Helps Exporters

| Feature | Exporter Benefit |

|---|---|

| HS Code Intelligence | Helps select the most accurate and up-to-date classification |

| Buyer Insights | Access real-time importer data across European countries |

| Forecast Reports | Plan shipments with clarity on seasonality, volume, and pricing |

With EximDataHub.com, you reduce risk, save time, and connect directly with verified international buyers without third-party noise.

🔹 Conclusion

Europe’s appetite for organic goods isn’t slowing down. For Indian exporters, this means a golden opportunity to position themselves as trusted, transparent suppliers. Whether you’re exporting turmeric, honey, or herbal teas—what matters is certification, consistency, and clarity.

To stay competitive, make smart use of data, market trends, and demand forecasts. Tools like EximDataHub give you the intelligence needed to succeed in global organic exports.

Want to export smarter? Use Exim Data Hub to stay ahead in global trade.

🔹 Frequently Asked Questions (FAQ)

Q1: Is certification required to export organic products to Europe?

Yes. Certification from an EU-recognized organic certifier is necessary to enter European markets.

Q2: What’s the size of the European organic market?

As of 2024, Europe’s organic food market is valued at around €59 billion, with consistent year-on-year growth.

Q3: Which organic products are most popular in Europe?

Tea, spices, forest honey, and organic fruits are leading the demand curve.

Q4: How does Exim Data Hub support exporters?

It provides HS code verification, buyer directories, and import/export data trends to help you plan better and reach real buyers.