Explore the latest trends, market data, and export insights for Indonesia’s shipments to its most important global partners. This guide highlights trade opportunities, top-importing countries, and essential HS-code information to help businesses make informed export decisions.

🔹 Introduction

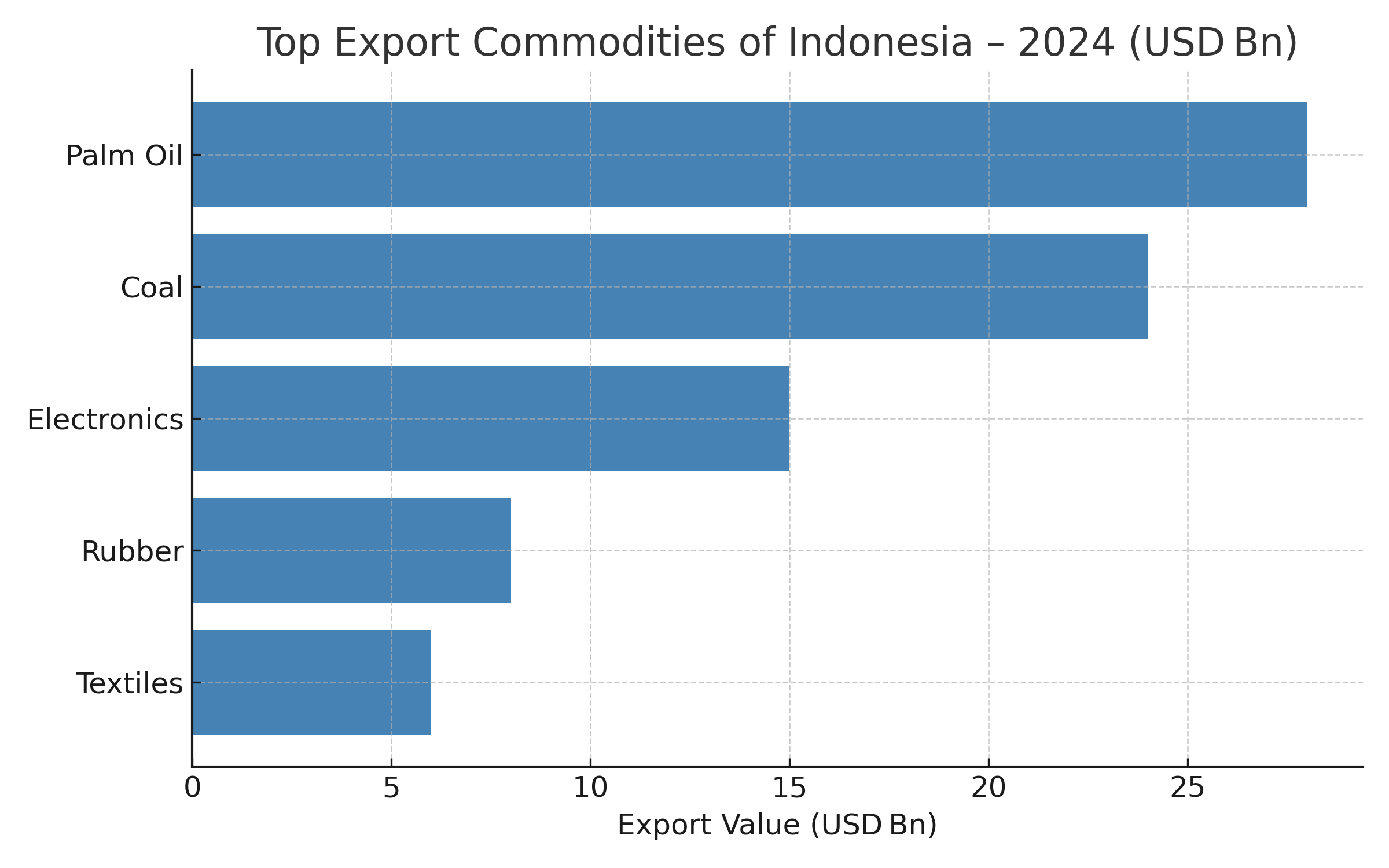

Global buyers have come to rely on Indonesia for palm oil, coal, electronics, rubber, footwear, and a growing list of value-added goods. In 2024 the country’s exports topped USD 258 billion, up 5 % year-on-year, with Asia and North America taking the lion’s share. Understanding who buys the most from Indonesia—and why—helps exporters price, package, and position their products for 2025. This article breaks down Indonesia’s ten biggest partners, shows where the demand is rising fastest, and explains how tools like Exim Data Hub streamline compliance and buyer discovery.

🔹 What Are “Trading Partners”?

A trading partner is any country that routinely imports or exports goods and services with Indonesia. These relationships shape tariff policy, currency flows, and even shipping routes. For exporters, knowing the partner list matters because:

➤ It signals stable demand that supports long-term contracts.

➤ It reveals which HS codes clear customs fastest.

➤ It points to where price or quality upgrades have the biggest payoff.

Indonesia’s current top partners include China, the United States, India, and Japan; each buys a different mix—energy in the case of India, electronics for the U.S., and palm oil for China.

🔹 Key Market Trends in Indonesia’s Export Network

| Market Driver | Description |

|---|---|

| ➤ Diversification | Indonesia is moving from raw commodities to higher-margin finished goods such as PC components, apparel, and processed foods. |

| ➤ ASEAN Integration | Tariff reductions under ASEAN FTAs have expanded shipments to Singapore, Malaysia, and Vietnam. |

| ➤ Sustainability Push | Importing nations now require ESG proof for palm oil, coal, and forestry products, prompting exporters to adopt traceability tools. |

Indonesia shipped 4.5 million t of additional palm-oil-based value-added goods in 2024, while electronic-integrated-circuit exports jumped 8 % to Japan and South Korea. Meanwhile, global fertilizer shortages boosted Indonesia’s coal exports to India by 12 %.

🔹 Top 10 Export Partners (2024–25)

| Rank | Country | Export Share | Key Goods |

|---|---|---|---|

| 1 | China | 21.3 % | Palm oil, coal, nickel matte |

| 2 | United States | 11.2 % | Furniture, footwear, electronics |

| 3 | India | 10.1 % | Coal, palm oil, copper concentrate |

| 4 | Japan | 9.5 % | Natural gas, automotive parts |

| 5 | Singapore | 6.9 % | Refined fuels, gold, machinery |

| 6 | South Korea | 5.8 % | Steel, electronics sub-assemblies |

| 7 | Malaysia | 5.2 % | Palm oil derivatives, plastics |

| 8 | Netherlands | 3.7 % | Palm oil, cocoa products |

| 9 | Vietnam | 3.1 % | Coal briquettes, rubber |

| 10 | Philippines | 2.9 % | Automotive fuel, building materials |

Indonesia’s supply ties with China deepened in 2024 on the back of nickel-based EV battery materials, while U.S. demand grew for Indonesian finished furniture and garments. Regional proximity keeps shipping costs low for Singapore and Malaysia, reinforcing their status as re-export hubs.

🔹 Opportunities for Exporters in 2025

➤ Tap ASEAN duty-free quotas for processed foods and beverages.

➤ Pitch eco-labelled palm-oil derivatives to Europe and the U.S.

➤ Bundle coal with logistics services for Indian utilities facing freight bottlenecks.

➤ Offer recycled-polyester textiles to brands in Japan and South Korea aiming for circular fashion targets.

Exporters applying predictive analytics through Exim Data Hub spot such niches early and quote competitively.

🔹 HS Codes for Indonesia’s Main Export Lines

➤ 151190 – Crude palm oil

➤ 270112 – Bituminous coal

➤ 854231 – Electronic integrated circuits

➤ 520852 – Dyed woven cotton fabrics

Using the wrong HS code can delay shipments and trigger re-inspection fees. If in doubt, check the latest tariff schedule and request HS Code Intelligence via Exim Data Hub.

🔹 How Exim Data Hub Helps Exporters

| Feature | Benefit |

|---|---|

| ➤ HS Code Intelligence | Accurate, country-specific classification to avoid fines |

| ➤ Verified Buyer Lists | Direct contacts in 70+ markets for faster lead closure |

| ➤ Market Forecasts | Volume & price projections to time your shipments |

| ➤ Compliance Updates | One-click access to ESG, halal, and phytosanitary rules |

Indonesia’s exporters cut research time by up to 40 % when they rely on Exim Data Hub’s real-time customs feeds and shipment analytics. For a personalized demo

🔹 Conclusion

Indonesia’s trade horizon for 2025 looks bright—driven by resilient Asian demand and new niches in sustainable products. Exporters who master HS codes, track buyer patterns, and align with ESG requirements will thrive.

➤ Focus on product traceability and documentation.

➤ Build long-term relationships in Asia while exploring Europe’s green demand.

➤ Leverage data platforms like Exim Data Hub for quicker decisions and reduced risk.

Ready to expand your reach? Connect with Exim Data Hub and unlock country-wise buyer insights today.

🔹 FAQ

Q1 – Do I need special certification to export food products?

Yes, many partners require halal or ISO 22000 compliance and lab testing.

Q2 – How large is Indonesia’s total export market?

Over USD 258 billion in 2024, according to national trade data.

Q3 – How do I find buyers for my commodity?

Use Exim Data Hub’s verified importer lists, complete with recent shipment volumes.