Explore the latest trade insights, export trends, and HS-coded data behind Brazil’s global trade network. This guide highlights top destinations, key commodities, and opportunities helping exporters understand Brazil’s position in global markets.

🔹 Introduction

Brazil stands as Latin America’s largest economy and one of the world’s leading export powerhouses. In 2024, Brazil’s total exports reached nearly USD 340 billion, supported by strong performance in commodities such as soybeans, crude oil, iron ore, and manufactured goods.

Its diversified export portfolio and expanding trade relationships with Asia, Europe, and the Americas have made Brazil a critical player in global supply chains. For exporters, understanding Brazil’s trade flow is essential to identify where demand is growing and which partners drive the bulk of its shipments.

This blog dives deep into Brazil’s top trading partners, export trends, HS codes, and key opportunities for 2025.

🔹 What Are Brazil’s Major Exports?

Brazil’s export strength lies in a mix of natural resources, agricultural products, and industrial goods that cater to both developed and emerging markets.

➤ Soybeans & Agricultural Products – Brazil is the world’s largest exporter of soybeans, corn, beef, and poultry. These products dominate shipments to China, the EU, and the Middle East.

➤ Crude Oil & Petroleum Products – Oil exports have grown rapidly due to offshore production an d new refineries, mainly targeting China, India, and Europe.

➤ Iron Ore & Steel – Essential to global construction and manufacturing, Brazil’s iron ore exports form a core part of trade with Asia.

➤ Machinery & Industrial Goods – Brazil’s industrial base supplies Latin America with vehicles, engines, and electrical equipment.

➤ Coffee & Processed Food – Brazil remains the world’s top coffee exporter, while food processing adds value to its agricultural exports.

These categories represent both Brazil’s traditional strengths and its push toward diversification through higher-value goods.

🔹 Key Market Trends in Brazil

| Market Driver | Description |

|---|---|

| ➤ Trade Diversification | Brazil is expanding exports beyond China and the US, targeting the Middle East, ASEAN, and Africa. |

| ➤ Agro-Industrial Integration | The country is increasing exports of processed agricultural products for higher value. |

| ➤ Green Economy Transition | Brazil is investing in renewable energy and sustainable commodity certification to boost export credibility. |

In 2024, China remained Brazil’s largest trading partner, accounting for roughly one-third of all exports — mainly soybeans, crude oil, and iron ore. The United States ranked second, importing energy, aircraft parts, and industrial goods.

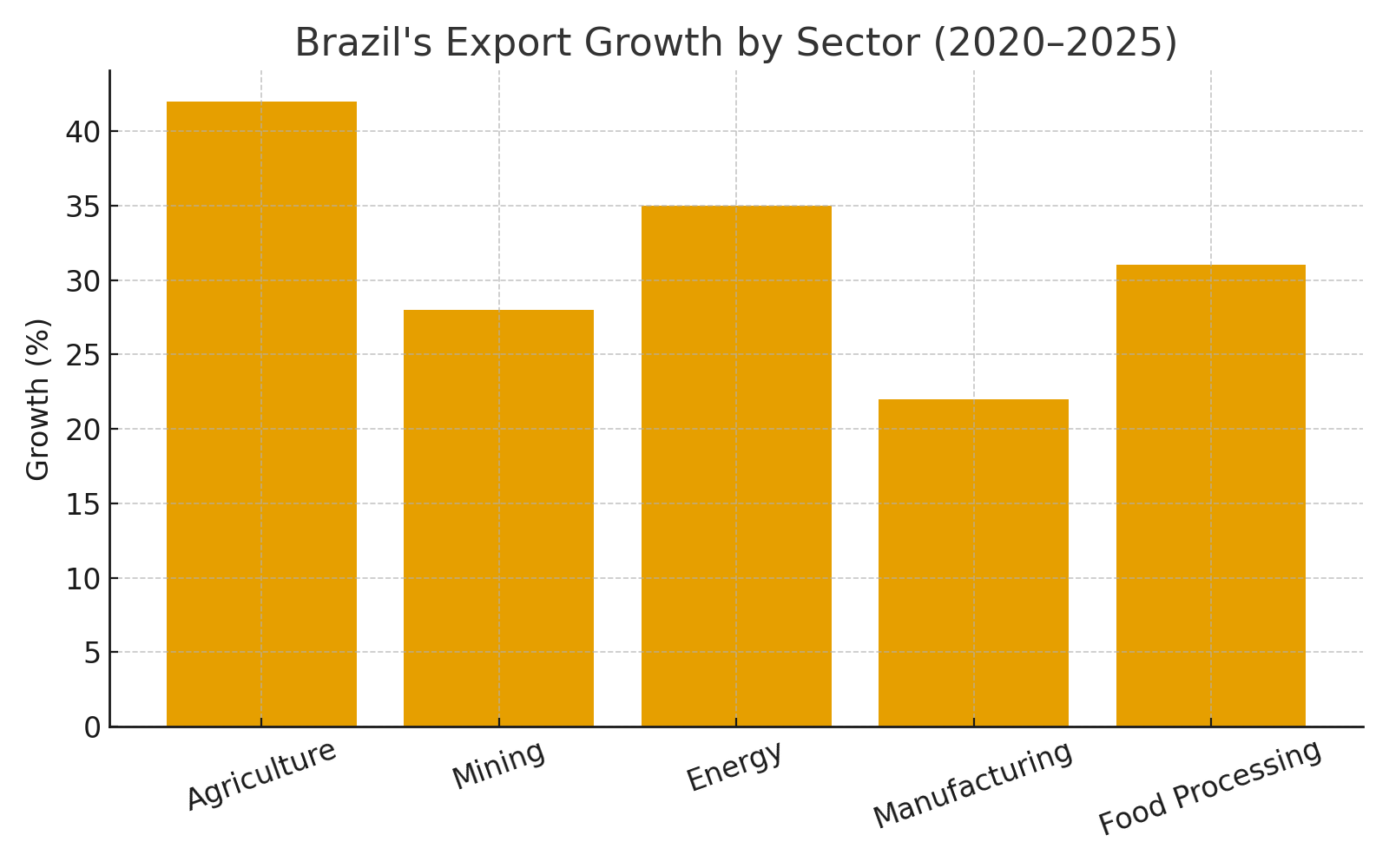

Brazil’s export growth in manufacturing and food processing is particularly noteworthy — reflecting how value-added products are slowly catching up with raw commodity exports.

For real-time shipment analytics and market insights, exporters can explore EximDataHub.com

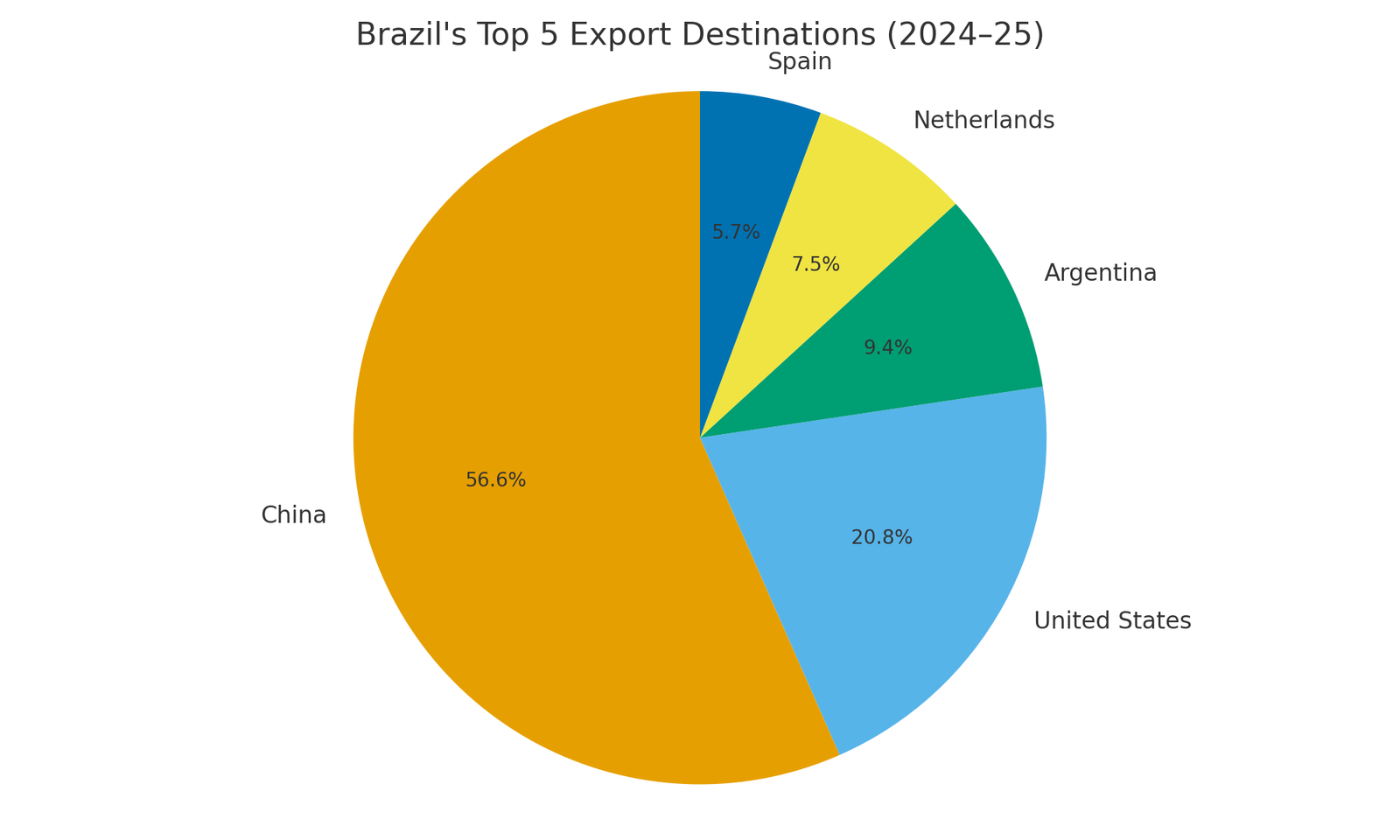

🔹 Top Trading Partners of Brazil (2024–25)

| Destination | Share of Total Exports (%) |

|---|---|

| ➤ China | 30% |

| ➤ United States | 11% |

| ➤ Argentina | 5% |

| ➤ Netherlands | 4% |

| ➤ Spain | 3% |

China leads Brazil’s export network due to its huge demand for soybeans, crude oil, and iron ore. Meanwhile, the United States and Argentina remain strong regional partners for industrial and agricultural goods. Europe continues to be a steady market for food, ethanol, and metals.

🔹 Opportunities for Exporters

As global trade evolves, Brazil’s exporters can benefit from strategic shifts in production, certification, and sustainability:

➤ Processed Food Exports – Rising global demand for packaged meat, sugar, and dairy products.

➤ Renewable Energy Equipment – Exports of ethanol, biodiesel, and green technologies are gaining attention.

➤ Eco-Certified Agriculture – Premium markets in Europe and Japan reward certified sustainable produce.

➤ Industrial Collaboration – Partnerships in automotive parts, chemicals, and machinery with Mexico and ASEAN nations.

➤ Data-Driven Export Planning – Tools like EximDataHub.com offer verified buyer data and HS code classification to simplify decision-making.

🔹 HS Codes for Brazil’s Key Exports

Here are a few HS codes representing Brazil’s top export categories:

➤ 12019000 – Soybeans, whether or not broken

➤ 27090000 – Crude petroleum oils

➤ 26011100 – Iron ores and concentrates

➤ 09011100 – Coffee, not roasted

➤ 87032300 – Passenger motor vehicles

Having accurate HS codes ensures smooth customs clearance and precise tariff calculation. Exporters can cross-check data through EximDataHub.com or reference international trade platforms like the International Trade Centre’s Trade Map.

🔹 How Exim Data Hub Helps Exporters

| Feature | Exporter Benefit |

|---|---|

| ➤ HS Code Intelligence | Find exact product codes and avoid clearance issues. |

| ➤ Buyer/Seller Insights | Access verified importer contacts in target regions. |

| ➤ Forecast Reports | Identify top-growing markets with predictive insights. |

| ➤ Compliance Tools | Stay compliant with updated trade documentation and regulations. |

Whether you’re managing agricultural shipments or industrial exports, Exim Data Hub provides the intelligence needed to scale your trade confidently across 100+ markets.

🔹 Conclusion

➤ Brazil’s trade ecosystem remains robust, combining resource wealth with emerging industrial capabilities.

➤ Understanding trade patterns, destinations, and HS codes helps exporters stay competitive in changing global markets.

➤ Platforms like Exim Data Hub simplify exporting with verified data, compliance tools, and buyer insights.

Want to export smarter?

Use EximDataHub.com to plan effectively, connect globally, and grow faster.

🔹 Frequently Asked Questions (FAQ)

Q1: Which country is Brazil’s largest trading partner?

A: China, accounting for about 30% of total exports in 2024–25.

Q2: What are Brazil’s main export categories?

A: Soybeans, crude oil, iron ore, coffee, and machinery lead the list.

Q3: What new export sectors are emerging?

A: Renewable energy equipment, processed foods, and sustainable farming products.