Explore the latest trade insights, market data, and export trends shaping Peru’s global shipments. This guide highlights Peru’s top trading partners, major export categories, HS codes, and emerging opportunities for 2025 — helping exporters make smart, data-driven decisions.

🔹 Introduction

Peru has grown into one of Latin America’s most reliable export economies, backed by strong mining output, agricultural diversity, and expanding industrial capabilities. In 2024, Peru’s total exports crossed USD 66 billion, with copper, gold, fishmeal, blueberries, and agricultural products leading the way.

Its strategic trade relationships with China, the United States, the EU, and regional partners create a steady demand pipeline for Peruvian commodities. As global supply chains shift toward cleaner minerals and high-value foods, Peru has become a key supplier.

This blog explains Peru’s major export categories, HS codes, market trends, and emerging partner opportunities — helping exporters plan smarter for 2025.

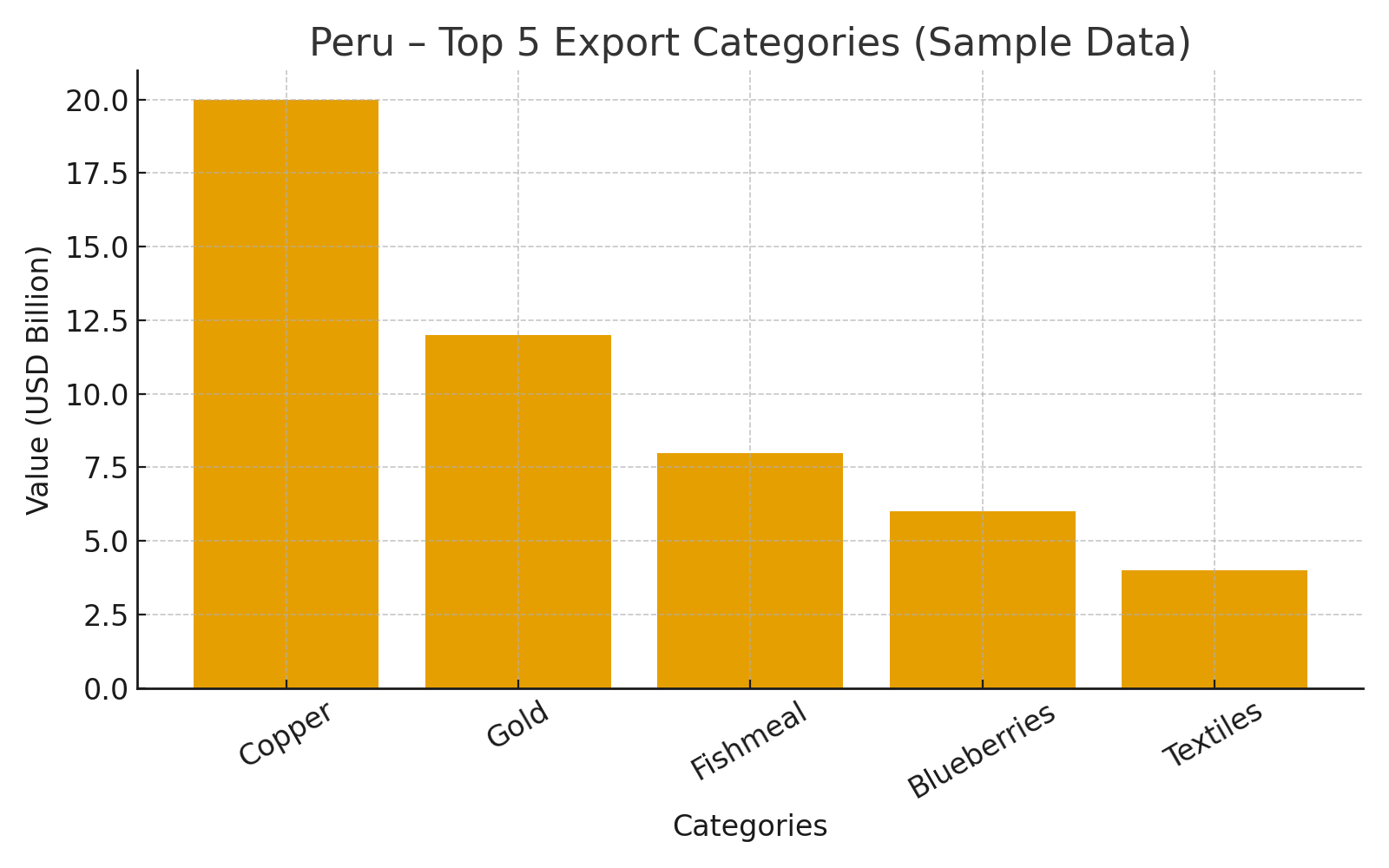

🔹 What Are Peru’s Major Exports?

Peru’s exports reflect a mix of mineral wealth, agriculture, and marine resources. These categories show how the country balances raw materials with growing value-added production.

➤ Copper & Minerals – Peru is one of the world’s largest copper exporters, with strong shipments going to China and East Asia. Copper ore and refined copper form the backbone of Peru’s trade.

➤ Gold & Precious Metals – Gold exports continue to support the economy, with demand from Europe, the U.S., and India.

➤ Fishmeal & Seafood – Peru leads globally in fishmeal exports, supplying aquaculture and livestock industries.

➤ Agricultural Goods (Blueberries, Grapes, Avocados) – High-value fruits and vegetables have seen immense growth, especially in the U.S. and European markets.

➤ Textiles & Clothing – Cotton, alpaca wool, and knitted garments contribute to Peru’s industrial export strength.

These sectors show how Peru blends raw resource power with an expanding agro-industrial sector.

🔹 Key Market Trends in Peru

➤ Mineral Demand Surge | Copper, zinc, and lithium demand rising due to global EV and clean-energy manufacturing.

➤ Agro-Export Expansion | Blueberries, avocados, quinoa, and grapes continue gaining traction in North America and Europe.

➤ Trade Diversification | Peru growing shipments to India, South Korea, Mexico, and ASEAN nations.

Demand for fishmeal also increased from China and Southeast Asia, driven by higher aquaculture output.

These shifts show how Peru’s export basket is gradually diversifying away from gold and minerals toward agriculture and processed food.

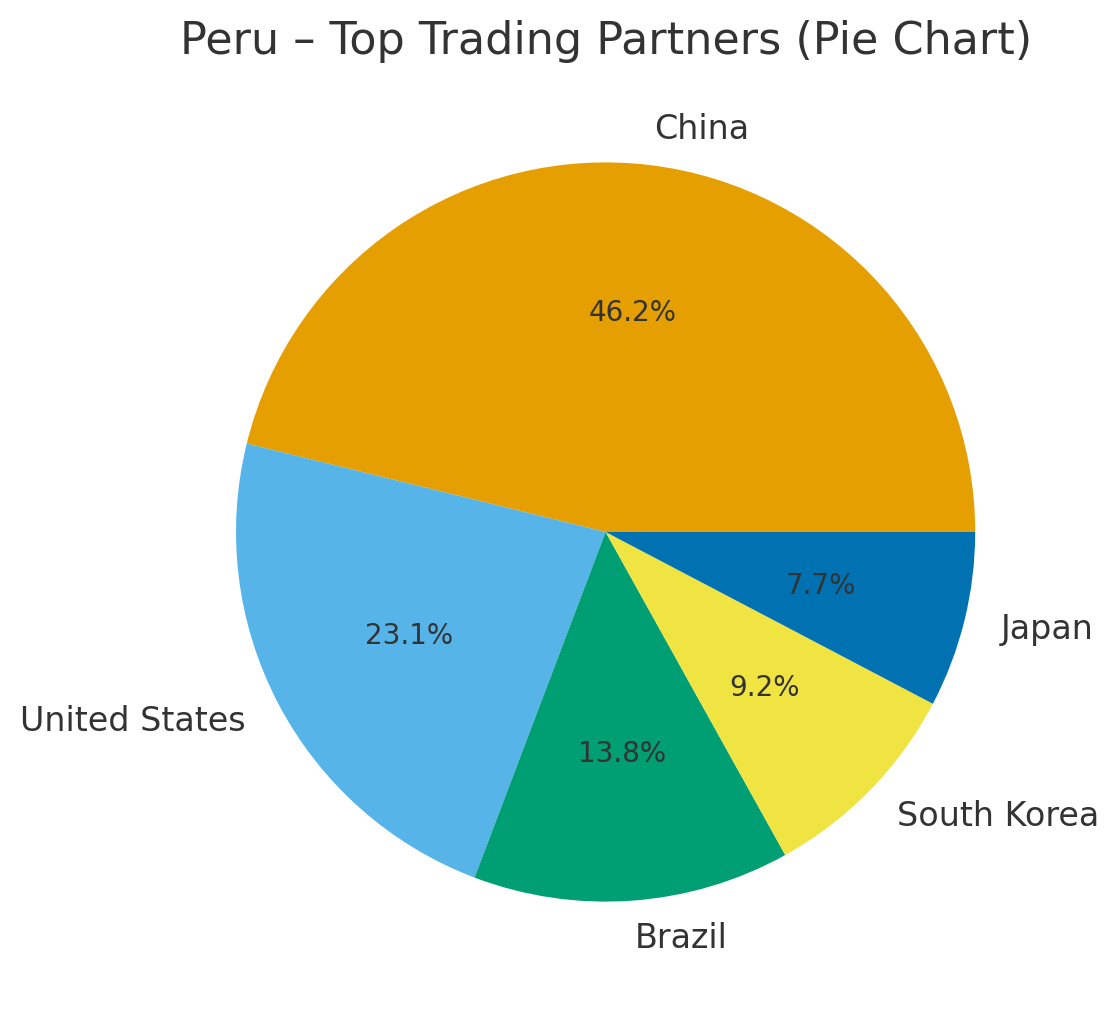

🔹 Top Trading Partners of Peru (2024–25)

Destination | Share of Total Exports (%)

➤ China – 33%

➤ United States – 18%

➤ European Union – 12%

➤ South Korea – 6%

➤ India – 5%

China remains Peru’s most important partner due to massive demand for copper and minerals.

The United States leads in agricultural imports such as blueberries, grapes, avocados, and textiles.

The European Union drives demand for gold, seafood, and high-value foods, while India is emerging as a major buyer of gold and minerals.

🔹 Opportunities for Exporters

➤ Premium Agro-Products – Organic-certified blueberries, quinoa, cocoa, and avocados fetch better pricing in the U.S. and EU.

➤ Clean-Energy Minerals – Copper, lithium, and zinc offer long-term export opportunities as global EV demand increases.

➤ Processed Marine Products – Fish oil, canned seafood, and value-added marine exports are expanding fast.

➤ Niche Textiles – Alpaca fiber and premium cotton apparel have high demand in Asia and Europe.

➤ Data-Driven Market Expansion – Exporters using verified datasets via

EximDataHub.com get quicker buyer discovery and HS classification support.

🔹 HS Codes for Peru’s Major Exports

Here are common HS codes linked to Peru’s export categories:

➤ 26030000 – Copper ores and concentrates

➤ 71081200 – Gold, unwrought

➤ 23012000 – Fishmeal and fish oil

➤ 08092100 – Fresh grapes

➤ 09019000 – Cocoa products

For cross-verification, exporters can also compare HS codes using the International Trade Centre’s Trade Map

🔹 How Exim Data Hub Helps Exporters

Feature | Exporter Benefit

➤ HS Code Intelligence | Avoid wrong classification and prevent shipment delays.

➤ Buyer/Seller Insights | Access verified importer lists for 100+ countries.

➤ Forecast Reports | Track market demand and seasonal export patterns.

Whether you’re exporting copper, fruits, or fishmeal, Exim Data Hub helps you access reliable trade data, find buyers, and plan your shipments with confidence.

🔹 Conclusion

➤ Peru’s exports reflect strong demand for minerals, seafood, and premium agriculture.

➤ Growth markets in the U.S., China, India, and the EU create fresh opportunities for 2025.

➤ Exporters who rely on accurate HS codes, demand forecasts, and verified buyer data can scale faster.

Want to export smarter?

Visit EximDataHub.com to connect with verified tools and trade intelligence.

🔹 Frequently Asked Questions (FAQ)

Q1: Which country is Peru’s largest export partner?

➤ China — mainly due to copper, gold, and mineral demand.

Q2: What are Peru’s top exports?

➤ Copper, gold, fishmeal, blueberries, avocados, and textiles.

Q3: Which sectors are growing in 2025?

➤ Agro-products, lithium minerals, and value-added seafood.