Explore the latest trends, market data, and export insights for wheat shipments from India to key global destinations. This guide highlights trade opportunities, top wheat-importing countries, and essential HS code information to help businesses make informed export decisions.

🔹 Introduction

The global demand for wheat continues to rise, driven by its role as a staple food in most countries. In recent years, countries in Asia, the Middle East, and Africa have increasingly turned to India to meet their wheat supply needs. This shift comes amid global supply disruptions, climate challenges, and food security strategies.

India, being the second-largest wheat producer globally, has become a strategic exporter when countries seek cost-effective and reliable grain sources. In this blog, we’ll walk you through the entire export process, key markets, HS Codes, and how platforms like EximDataHub.com can assist exporters at every step.

🔹 What is Wheat?

Wheat is a cereal grain grown extensively across India’s northern plains, especially in states like Punjab, Haryana, Madhya Pradesh, and Uttar Pradesh. Indian wheat, particularly durum wheat, is valued for its quality and suitability for flatbreads, chapatis, and pasta.

In international markets, Indian wheat is gaining attention for:

➤ Competitive pricing

➤ Consistent availability

➤ Suitability for milling, baking, and animal feed

From flour mills in Indonesia to food processors in the UAE, Indian wheat has made its mark across both developing and developed markets.

🔹 Key Market Trends in Wheat Importing Countries

| Market Driver | Description |

|---|---|

| Food Security Concerns | Many countries are stockpiling wheat post-COVID |

| Diversification Strategy | Buyers prefer multiple sources, reducing overdependence on major players |

| Price Advantage | Indian wheat often undercuts global competitors on price |

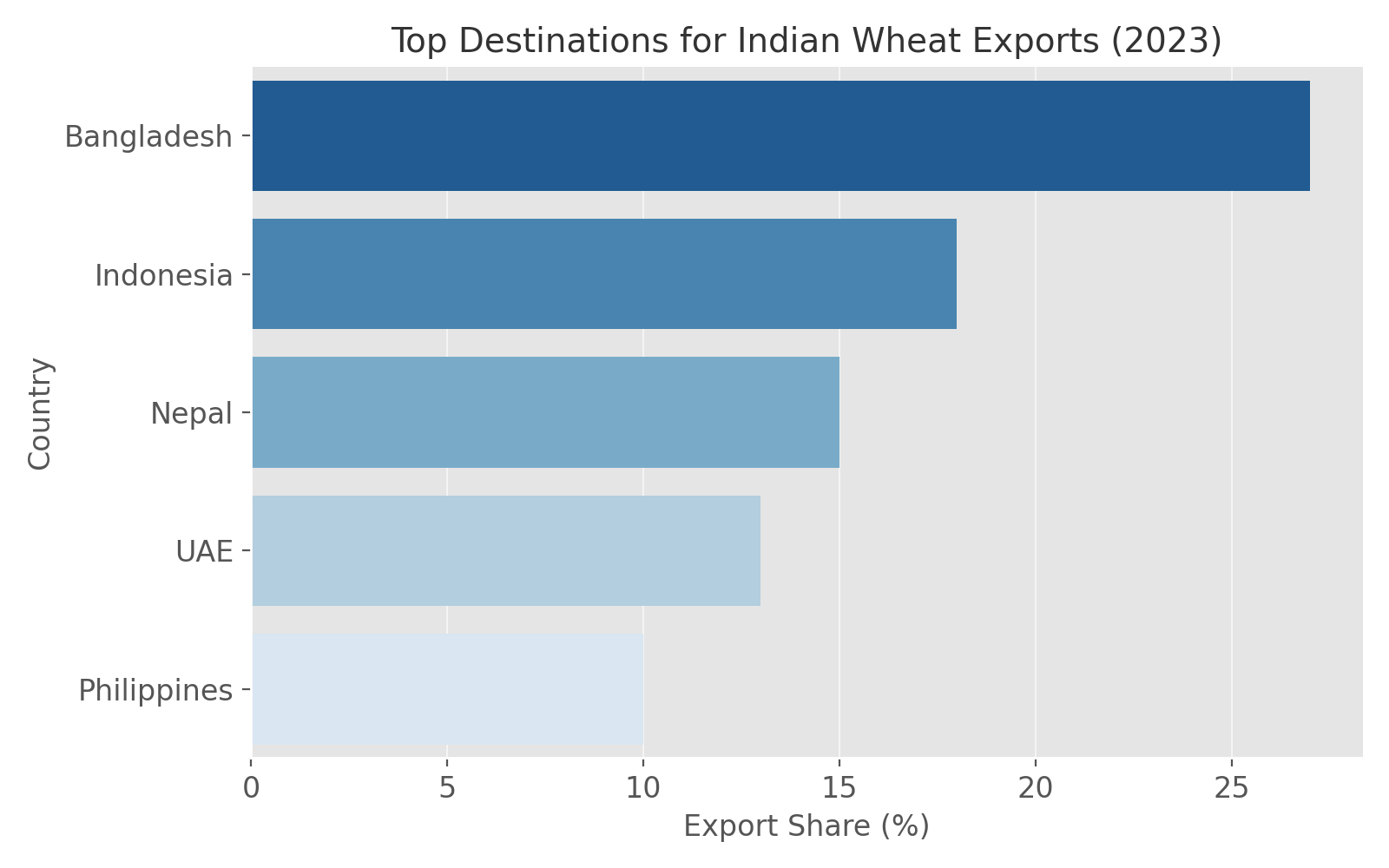

India exported over 4.5 million tonnes of wheat in 2023, with major buyers including Bangladesh, Indonesia, and the UAE. According to TradeMap.org, the export volume grew 12% YoY, primarily due to global supply gaps and India’s timely government support for exporters.

Another trend driving Indian wheat’s popularity is the rising interest in whole grain and organic options across Western countries. Countries like the USA and UK have shown growing interest in organic Indian wheat.

🔹 Top Exporting Countries

| Country | Export Share (%) |

|---|---|

| Russia | 20% |

| Canada | 14% |

| USA | 13% |

| India | 9% |

| Australia | 7% |

India, while not yet the top exporter globally, has seen its market share rise quickly, especially in Southeast Asia, Africa, and Middle Eastern markets. Its flexibility with trade terms and shorter lead times often give it an edge over traditional exporters.

🔹 Opportunities for Exporters

➤ Organic wheat exports to health-conscious markets like the USA, UK, and Germany

➤ Trade tie-ups with millers and food manufacturers in East Africa and Southeast Asia

➤ High seasonal demand in Ramadan and festival periods

➤ Export to food aid programs and NGOs sourcing for humanitarian relief

🔹 HS Code for Wheat

When exporting wheat, it’s essential to use the correct HS Code to avoid delays or misclassification.

Here are a few commonly used HS Codes for Indian wheat exports:

100111 – Durum wheat, seed grade

100119 – Durum wheat, non-seed

100191 – Wheat for sowing

100199 – Other wheat and meslin

Accurate HS code usage not only helps with compliance but also ensures correct tariff calculation. If you need help classifying your shipment,

🔹 How Exim Data Hub Helps Exporters

| Feature | Exporter Benefit |

|---|---|

| HS Code Intelligence | Easy access to accurate, country-specific codes |

| Verified Buyer Lists | Get in touch with real importers in over 70+ countries |

| Trade Forecast Reports | Plan ahead with volume and pricing projections |

Exim Data Hub also provides shipment analysis, custom clearance support, and market insights based on real-time customs data. Whether you’re exporting wheat in bulk containers or bagged form, we help streamline the process with data-driven insights.

Need help setting up your wheat export operation? Contact us now.

🔹 Conclusion

Indian wheat is well-positioned to grow its share in global markets, especially with ongoing geopolitical shifts, food inflation, and rising consumption. Exporters who understand the nuances of documentation, buyer behavior, and seasonal patterns can succeed even in competitive markets.

➤ Focus on quality and correct HS classification

➤ Build long-term buyer relationships in price-sensitive markets

➤ Use tools like Exim Data Hub to get verified data and avoid compliance mistakes

Want to export smarter? Use Exim Data Hub to stay ahead in global trade.

🔹 Frequently Asked Questions (FAQ)

Q1: Is certification required for exporting wheat from India?

Yes, certifications like Phytosanitary Certificate, FSSAI, and sometimes Organic Certification (for niche markets) are required based on the importing country’s norms.

Q2: How large is the current global market for wheat?

The global wheat trade is valued at over $50 billion annually, with India contributing roughly $2.5–3 billion as per the latest available data.

Q3: How can I find verified wheat buyers overseas?

You can use Exim Data Hub to access live buyer contacts, past import records, and top-performing markets. Click here to get started.

Q4: Can I export wheat without government registration?

No. You must have an IEC (Import Export Code) and be registered with APEDA or other relevant authorities depending on your shipment type.