Explore real trade data, growth forecasts, and partnership dynamics between the U.S. and Asia’s leading economies. This guide reveals market insights, key export-import flows, and trade opportunities across the region.

🔹 Introduction

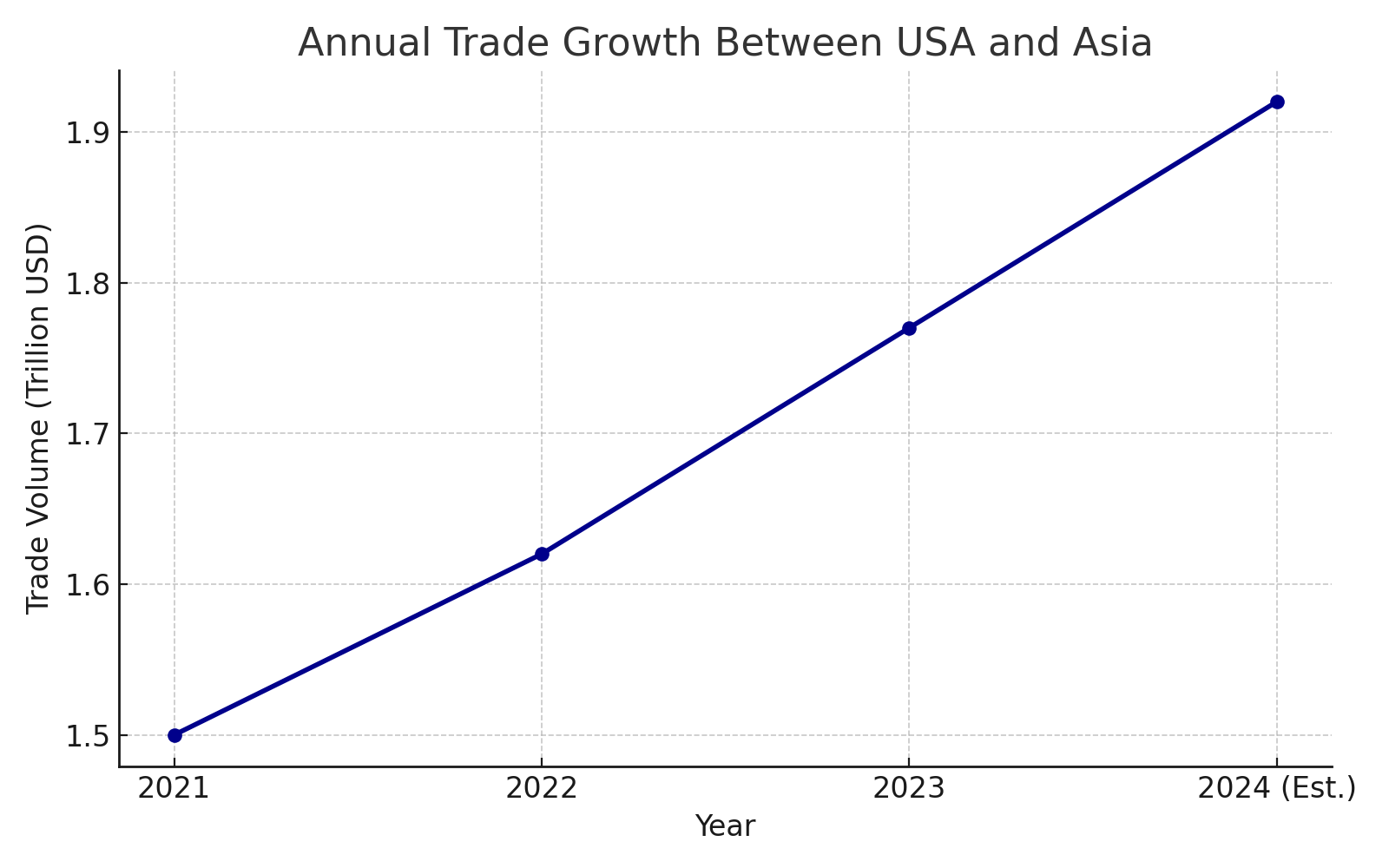

The economic ties between the United States and Asia are stronger than ever. In 2024, Asia accounted for nearly 35% of America’s global trade, with demand driven by electronics, machinery, consumer goods, and energy.

🔹 Why Asia Matters to U.S. Trade

Asia is home to some of the world’s largest manufacturing and consumer markets. From technology exports to raw material imports, the U.S. relies heavily on this region to power its supply chains.

➤ Massive population centers = strong demand

➤ Home to major electronics and textile exporters

➤ Strategic ports and shipping lanes

➤ Trade agreements with multiple U.S. sectors

For updated insights on which commodities are growing and where the trade opportunities lie, platforms like EximDataHub offer critical data intelligence.

🔹 Key Market Trends in U.S.-Asia Trade

➤ The U.S. has increased technology imports from Southeast Asia

➤ Demand for American LNG (liquefied natural gas) surged in East Asia

➤ India’s role has grown, especially in pharmaceuticals and software

You can connect with EXIM Data Hub to get full access to commodity-wise trade graphs.

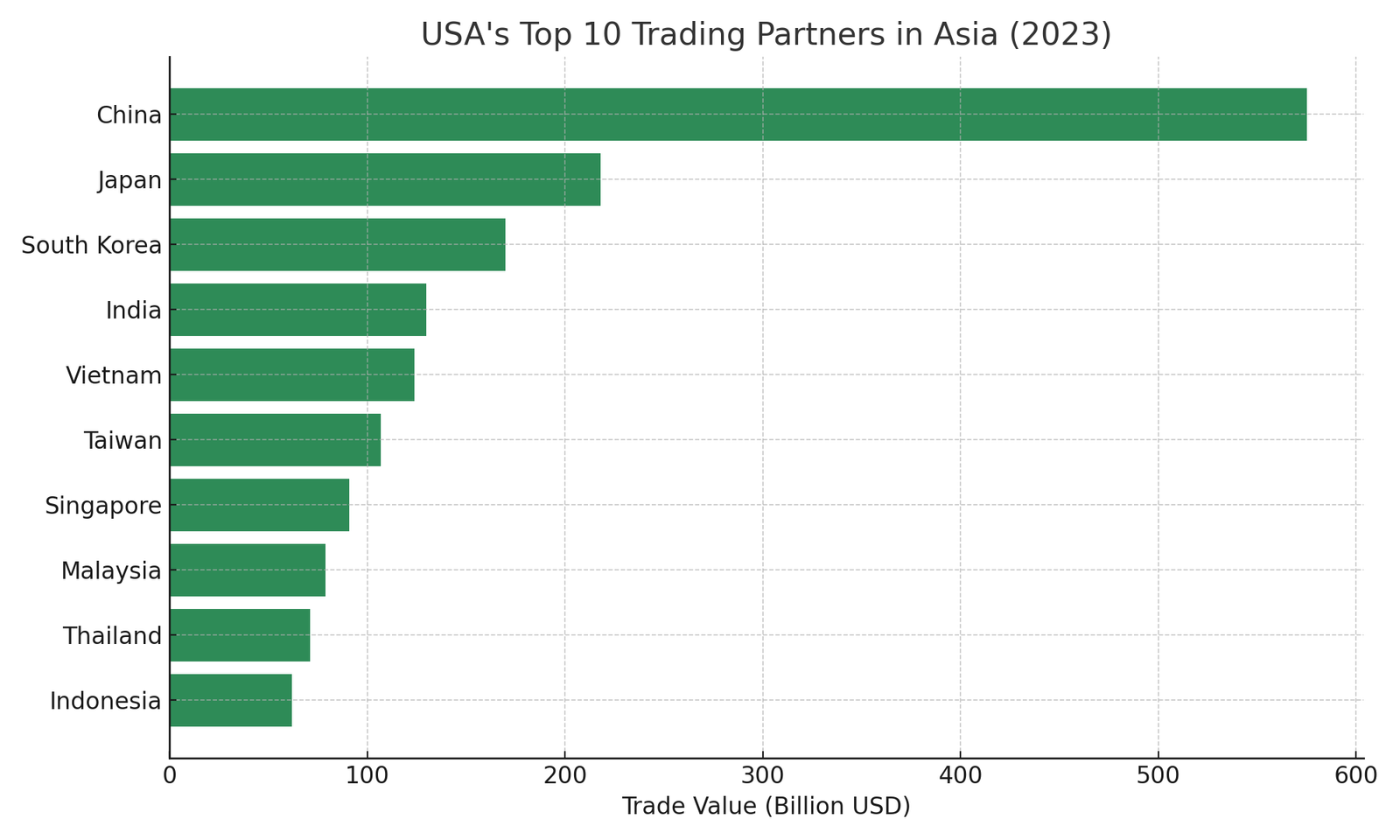

🔹 Top 10 Trading Partners in Asia

China leads by a large margin, especially in electronics and consumer goods. However, countries like Vietnam, India, and Indonesia have rapidly gained importance due to cheaper labor, improved logistics, and geopolitical shifts.

For accurate country-level analytics and past-year trade comparisons, use World Integrated Trade Solution or trusted tools like EXIM Data Hub.

🔹 Opportunities

➤ U.S. exporters can tap into rising demand in emerging Asian markets like Vietnam and Indonesia

➤ Electronics, machinery, renewable energy, and agri-products are high-potential sectors

➤ Trade facilitation has improved with Free Trade Agreements and digital documentation

➤ Rising middle-class demand in Asia presents huge consumer markets

For personalized country data, you can connect here.

🔹 HS Code Considerations for Key Products

When exporting or importing between the U.S. and Asia, correct HS code classification is vital.

➤ HS 8471 – Computers & Data Processing Machines

➤ HS 8542 – Electronic Integrated Circuits

➤ HS 2711 – Liquefied Natural Gas

➤ HS 8708 – Auto Parts

➤ HS 1006 – Rice (common in U.S.-Asia agri trade)

Refer to the WCO Harmonized System for standardized codes.

🔹 How Exim Data Hub Helps Traders

➤ HS Code Intelligence – Helps in classifying goods accurately to avoid customs delays

➤ Country-Specific Trade Graphs – Easily compare year-on-year trade volume

➤ Verified Buyer/Supplier Insights – Access contact-level data from verified traders

➤ Export Trends Dashboard – Spot high-growth markets in Asia using data-driven visuals

To explore how you can use these tools, visit EximDataHub

🔹 Conclusion

The trade landscape between the USA and Asia is constantly evolving. While China remains dominant, other countries like Vietnam, India, and Indonesia are rising quickly.

If you’re planning to enter or expand your trade activities in Asia, having up-to-date data can be your biggest competitive edge. Platforms like Exim Data Hub give you the insights to make smarter, faster, and more accurate export decisions.

👉 Want to unlock real-time trade trends? Visit Exim Data Hub now and take the guesswork out of your global strategy.

🔹 FAQs

Q1: What are the most traded items between the USA and Asia?

Electronics, machinery, mineral fuels, textiles, and agricultural goods dominate the trade lanes.

Q2: Which Asian country is growing fastest in trade with the USA?

Vietnam and India have seen the fastest growth in the past 3 years, particularly in electronics and specialty manufacturing.

Q3: Do I need separate documentation for each Asian country?

Yes, trade compliance varies by country. It’s best to use tools like EXIM Data Hub for accurate compliance support.

Q4: How can I find real-time trade shifts or buyer demand?

Use trade dashboards and data alerts from platforms like Exim Data Hub to monitor shifts in demand, supply, and pricing.